Discovering the Key Attributes of an Offshore Depend On for Wide Range Management

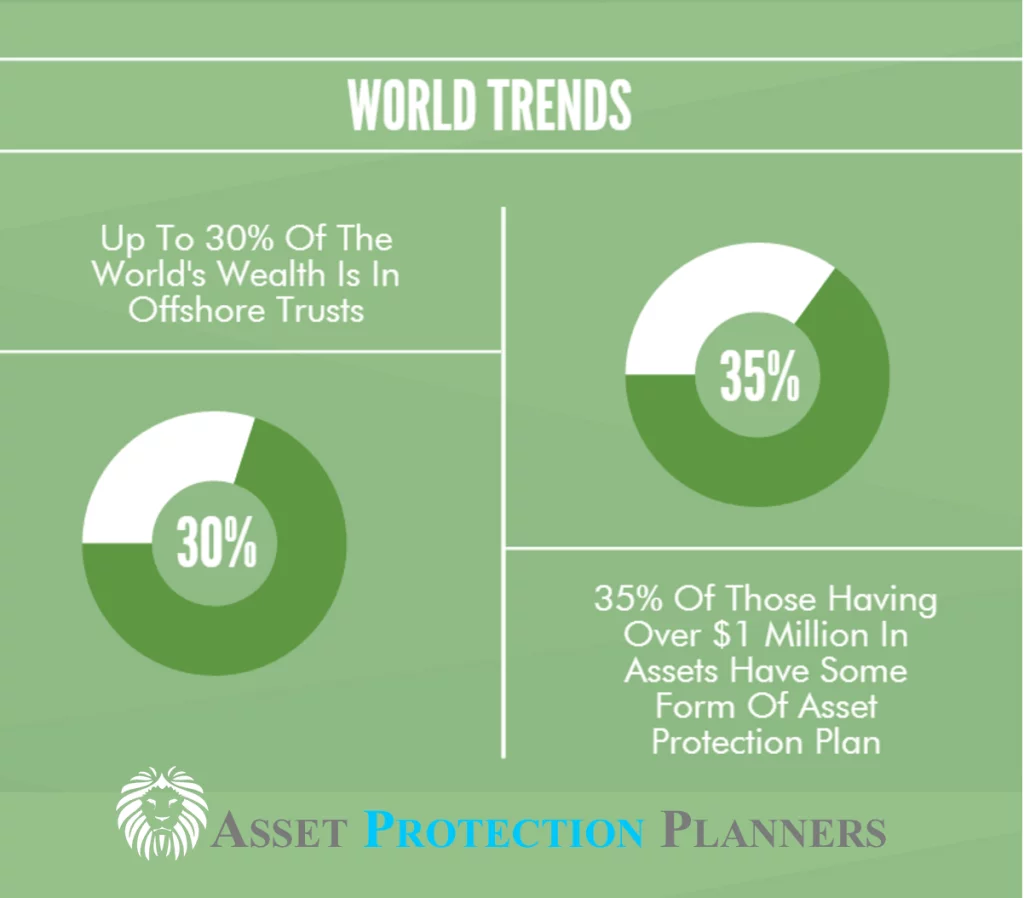

Offshore trust funds have actually acquired focus as a calculated device for wide range monitoring. They offer unique benefits such as asset defense, tax obligation optimization, and boosted privacy. These counts on can be tailored to satisfy particular financial objectives, guarding possessions from potential dangers. Nonetheless, there are necessary considerations to maintain in mind. Understanding the complexities of overseas counts on may reveal even more than simply benefits; it could reveal prospective difficulties that warrant mindful idea

Comprehending Offshore Trusts: A Primer

Offshore counts on might seem facility, they offer as important financial devices for people seeking to handle and protect their wealth. An offshore count on is a lawful arrangement where an individual, known as the settlor, transfers properties to a trustee in an international jurisdiction. This framework enables improved privacy, as the information of the count on are not subject and often confidential to public examination. In addition, overseas depends on can offer adaptability concerning possession administration, as trustees can be selected based on know-how and jurisdictional benefits. They can additionally be tailored to meet particular financial objectives, such as estate preparation or tax obligation optimization. Understanding the legal and tax implications of overseas trust funds is vital, as laws vary significantly throughout various nations. In general, these counts on supply a strategic method to riches management for those aiming to navigate complicated economic landscapes while enjoying certain benefits that domestic trusts may not provide.

Property Defense: Shielding Your Wealth

Asset protection is a critical consideration for individuals looking for to guard their riches from prospective legal cases, lenders, or unpredicted economic obstacles. Offshore counts on act as a tactical device for accomplishing this goal, giving a layer of safety that domestic properties might do not have. By transferring properties into an overseas count on, individuals can create a legal barrier between their wealth and possible complaintants, properly securing these assets from claims or personal bankruptcy proceedings.The territory of the offshore trust fund usually plays an important role, as lots of countries use durable lawful structures that secure trust assets from outside cases. Additionally, the anonymity given by offshore counts on can additionally hinder lenders from seeking insurance claims. It is important for people to understand the certain legislations controling property protection in their chosen territory, as this understanding is basic for making the most of the effectiveness of their wide range monitoring techniques. In general, overseas trusts stand for a proactive technique to preserving wide range versus uncertain monetary obstacles.

Tax Obligation Benefits: Browsing the Financial Landscape

Offshore trusts use substantial tax obligation benefits that can enhance wealth administration methods. They offer possibilities for tax deferral, allowing properties to grow without instant tax obligation implications. Additionally, these trusts might use inheritance tax advantages, additionally enhancing the economic heritage for recipients.

Tax Obligation Deferment Opportunities

Just how can individuals take advantage of offshore depend make the most of tax deferral chances? Offshore counts on provide a calculated opportunity for delaying tax obligations on earnings and resources gains. By placing possessions in an offshore trust fund, people can benefit from jurisdictions with favorable tax regimens, allowing for prospective deferral of tax obligation responsibilities till distributions are made. This device can be specifically advantageous for high-income earners or capitalists with substantial funding gains. Furthermore, the earnings generated within the trust may not undergo immediate taxes, allowing wealth to expand without the burden of annual tax responsibilities. Steering through the intricacies of international tax obligation legislations, individuals can successfully make use of offshore depend boost their riches management strategies while decreasing tax obligation direct exposure.

Inheritance Tax Benefits

Privacy and Privacy: Maintaining Your Affairs Discreet

Keeping personal privacy and privacy is essential for individuals seeking to secure their wide range and assets. Offshore trusts use a robust framework for securing individual info from public examination. By developing such a trust fund, individuals can effectively divide their individual affairs from their financial passions, ensuring that sensitive details remain undisclosed.The legal structures governing offshore depends on often give strong personal privacy defenses, making it hard for exterior events to gain access to info without approval. This level of confidentiality is especially attracting high-net-worth individuals concerned concerning prospective risks such as lawsuits or undesirable focus from creditors.Moreover, the distinct nature of offshore territories enhances personal privacy, as these areas normally impose rigorous guidelines surrounding the disclosure of depend on details. Consequently, people can take pleasure in the peace of mind that comes with understanding their financial strategies are secured from open secret, therefore preserving their wanted degree of discernment in wide range management.

Flexibility and Control: Customizing Your Trust Framework

Offshore counts on offer considerable versatility and control, permitting individuals to customize their trust structures to meet certain economic and personal goals. This versatility enables settlors to choose numerous elements such as the type of assets held, circulation terms, and the appointment of trustees. By choosing trustees who align with their objectives and values, look these up people can guarantee that their wide range is managed according to their wishes.Additionally, overseas trusts can be structured to fit transforming situations, such as fluctuations in monetary demands or family dynamics. This suggests that beneficiaries can obtain distributions my blog at specified intervals or under specific conditions, offering additional personalization. The capacity to modify trust arrangements also guarantees that the depend on can progress in reaction to lawful or tax adjustments, keeping its effectiveness with time. Ultimately, this level of adaptability equips people to create a depend on that lines up effortlessly with their lasting wide range management approaches.

Possible Disadvantages: What to Think about

What challenges might individuals face when taking into consideration an overseas trust fund for wide range administration? While overseas depends on supply different advantages, they additionally come with prospective drawbacks that necessitate cautious factor to consider. One substantial problem is the price connected with developing and maintaining such a count on, which can include lawful fees, trustee costs, and ongoing management expenses. In addition, individuals may encounter intricate regulatory demands that vary by jurisdiction, potentially complicating conformity and leading to charges otherwise complied with properly. Offshore Trust.Moreover, there is an intrinsic threat of currency fluctuations, which can influence the value of the possessions held in the trust. Depend on recipients may also encounter obstacles in accessing funds as a result of the management procedures included. Public assumption and potential scrutiny from tax obligation authorities can develop reputational threats. These elements necessitate thorough study and specialist guidance before waging an overseas trust for riches management

Secret Considerations Before Developing an Offshore Count On

Prior to establishing an offshore depend on, people should think about numerous crucial variables that can substantially affect their wide range management approach. Legal territory implications can affect the depend on's performance and conformity, while taxes factors to consider might influence total advantages. A complete understanding of these components is necessary for making educated choices regarding overseas trusts.

Lawful Jurisdiction Ramifications

When taking into consideration the facility of an overseas count on, the selection of legal territory plays a crucial duty in forming the trust's performance and protection. Different territories have varying legislations governing trust funds, consisting of laws on property protection, privacy, and conformity with international criteria. A jurisdiction with a durable lawful framework can improve the count on's authenticity, while those with less rigid laws may present risks. In addition, the credibility of the selected territory can influence the trust's understanding amongst recipients and banks. It is vital to assess aspects such as political security, legal precedents, and the schedule of skilled fiduciaries. Ultimately, choosing the ideal territory is crucial for accomplishing the desired objectives of property defense and wealth management.

Taxation Considerations and Advantages

Tax considerations considerably affect the decision to establish an overseas count on. Such trusts might use substantial tax obligation benefits, consisting of lowered revenue tax responsibility and possible estate tax obligation benefits. In several jurisdictions, revenue generated within the trust can be exhausted at lower prices or otherwise whatsoever if the recipients are non-residents. In addition, properties held in an overseas trust may not undergo residential estate tax, helping with wide range preservation. It is essential to navigate the intricacies of worldwide tax legislations to guarantee conformity and avoid challenges, such as anti-avoidance regulations. Subsequently, individuals should consult tax obligation professionals experienced in offshore frameworks to enhance advantages while sticking to relevant regulations and regulations.

Often Asked Concerns

Just how Do I Choose the Right Territory for My Offshore Trust fund?

Choosing the ideal territory for an offshore trust fund involves reviewing variables such as legal security, tax obligation ramifications, regulatory atmosphere, and privacy laws. Each territory supplies distinct benefits that can greatly affect riches monitoring techniques.

Can I Modification the Recipients of My Offshore Trust Later?

The capability you can find out more to transform recipients of an overseas trust fund depends upon the trust's terms and jurisdictional laws. Typically, numerous overseas trust funds permit alterations, but it is important to seek advice from lawful suggestions to assure conformity.

What Is the Minimum Amount Needed to Establish an Offshore Trust Fund?

The minimum amount called for to establish an offshore trust fund varies substantially by territory and service provider. Commonly, it ranges from $100,000 to $1 million, relying on the intricacy of the count on and connected costs.

Exist Any Type Of Lawful Constraints on Offshore Trust Investments?

The lawful constraints on overseas trust fund investments vary by jurisdiction. Typically, policies may limit certain property kinds, impose reporting requirements, or limit purchases with specific countries, guaranteeing compliance with global legislations and anti-money laundering steps.

Exactly how Do I Dissolve an Offshore Trust Fund if Needed?

To liquify an overseas trust, one must follow the terms described in the depend on act, guaranteeing compliance with applicable laws. Lawful suggestions is usually suggested to browse possible intricacies and determine all obligations are fulfilled. By transferring possessions right into an offshore trust, people can create a lawful barrier in between their wide range and potential complaintants, successfully securing these possessions from claims or bankruptcy proceedings.The jurisdiction of the offshore trust fund commonly plays a critical function, as many nations provide robust lawful structures that safeguard trust properties from exterior claims. By developing such a depend on, people can effectively divide their personal events from their financial rate of interests, guaranteeing that delicate information remain undisclosed.The legal frameworks governing offshore trust funds commonly provide strong personal privacy defenses, making it tough for external parties to gain access to information without approval. Offshore trust funds supply substantial flexibility and control, enabling individuals to tailor their count on frameworks to fulfill particular financial and personal objectives. When considering the establishment of an offshore trust, the option of lawful territory plays a crucial duty in shaping the depend on's efficiency and safety and security. The capability to transform recipients of an offshore depend on depends on the depend on's terms and administrative laws.